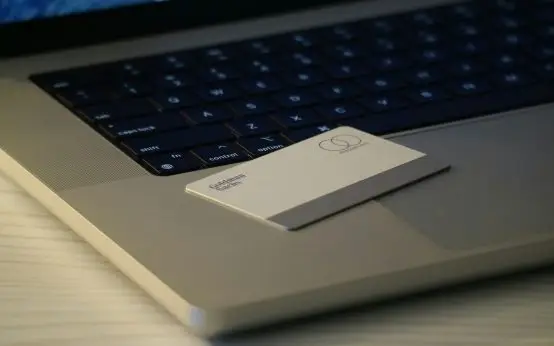

The Moi RBC Visa is built for Canadians who want a practical and rewarding way to manage daily expenses while earning value on every purchase. Whether you’re shopping at Metro, Brunet, Jean Coutu, Super C or other participating retailers, this card enhances your spending with accelerated Moi Points that can be redeemed for groceries, essentials and a variety of lifestyle products. Designed to support modern financial habits, it places powerful rewards into your hands with every swipe, tap or online payment.

What makes the Moi RBC Visa card especially appealing is its simplicity and adaptability. With no annual fee, strong earning potential and secure digital tools backed by RBC’s trusted banking network, the card serves as an accessible solution for families, students and professionals who want convenience without added financial obligations. From contactless payments and fraud protection to flexible online redemption, the Moi RBC Visa helps Canadians stretch their budgets while maintaining effortless control over their finances.

Key Advantages of the Moi RBC Visa Credit Card

1. Accelerated Moi Points at Participating Retailers

Earn enhanced Moi Points at Metro, Jean Coutu, Super C, Brunet and other brands within the Metro family, allowing your grocery and pharmacy purchases to build rewards quickly.

2. Strong Point Accumulation on Everyday Categories

Even purchases outside Metro-affiliated stores earn Moi Points, making daily expenses like fuel, dining or household items more rewarding overall.

3. No Annual Fee

Enjoy all earning opportunities and card benefits without paying an annual fee, making the Moi RBC Visa a cost-effective choice for Canadian households.

4. Flexible Redemption Options

Moi Points can be redeemed directly at checkout at participating stores or used for discounts on future purchases, allowing you to save instantly whenever you choose.

5. Mobile Wallet Compatibility

Add your Moi RBC Visa to Apple Pay, Google Pay or Samsung Pay for seamless, secure and contactless transactions on the go.

6. Built-In Purchase Protection

Eligible items are covered through purchase assurance and extended warranty protection, giving you confidence when buying electronics, appliances and higher-value goods.

7. Strong Fraud Monitoring and Zero Liability

The card includes RBC’s advanced fraud detection technology plus Zero Liability protection, ensuring unauthorized charges do not affect your finances.

8. Exclusive Offers Through RBC and Metro Partners

Cardholders may receive bonus point promotions, seasonal offers and partner-specific discounts that further increase the value of everyday spending.

9. Easy Online Account Management

The RBC mobile app and online banking tools allow you to track your rewards, check balances, view transactions and make payments from anywhere.

10. Supplementary Cards Available at No Cost

Add family members to the account for free and earn points even faster as their purchases contribute to your total earn rate.

11. A Card Designed for Daily Life

Whether you’re picking up groceries, managing pharmacy needs or shopping online, the Moi RBC Visa fits into your routine and rewards your regular spending patterns.

Who Can Apply for the Moi RBC Visa Credit Card?

Typical eligibility requirements include:

- Must be at least 18 or 19 years old, depending on provincial regulations

- Must be a Canadian resident

- A fair to good credit score is recommended for approval

- Must provide valid government-issued ID

- Must supply accurate personal, employment and financial information

- Must meet RBC’s standard creditworthiness criteria

Because the card has no annual income requirement, it is accessible to a wide range of applicants, including students and part-time workers.

How to Apply for the Moi RBC Visa – Step-by-Step Guide

- Visit the RBC or Moi Rewards official website.

- Navigate to the Credit Cards section and select the Moi RBC Visa.

- Review the benefits, features and eligibility details.

- Click Apply Now to begin the online application.

- Enter your personal and contact information.

- Provide employment and financial details.

- Upload identification or supporting documents if required.

- Carefully review the card terms and disclosures.

- Submit your application for processing.

- Wait for a decision; many applicants receive quick approvals.

- Receive your physical card by mail.

- Activate the card through RBC Online Banking or the mobile app.

- Begin earning Moi Points on every eligible purchase.

Frequently Asked Questions (FAQ)

1. Does the Moi RBC Visa have an annual fee?

No, the card does not charge an annual fee.

2. Where can I earn the most Moi Points?

Metro, Jean Coutu, Super C and Brunet locations offer the highest earning rates.

3. How do I redeem Moi Points?

You can redeem them directly at checkout or apply them toward future purchases at participating retailers.

4. Is this card accepted internationally?

Yes, it can be used anywhere Visa is accepted worldwide.

5. Does the card help build credit?

Yes, responsible use supports positive credit growth.

6. Can I add an additional cardholder?

Yes, supplementary cards are free.

7. Does the card offer purchase protection?

Yes — purchase assurance and extended warranty are included for eligible items.

8. Does the Moi RBC Visa support mobile wallets?

Yes, you can use Apple Pay, Google Pay and Samsung Pay.

9. How do I monitor my rewards?

Through the RBC mobile app or online banking platform.

10. Is the card secure for online payments?

Yes, with RBC’s fraud detection and Zero Liability coverage.

11. Are there bonus offers available?

Yes, RBC and Metro frequently offer promotional point bonuses for cardholders.

12. What credit score is needed for approval?

A fair to good credit score increases approval likelihood.